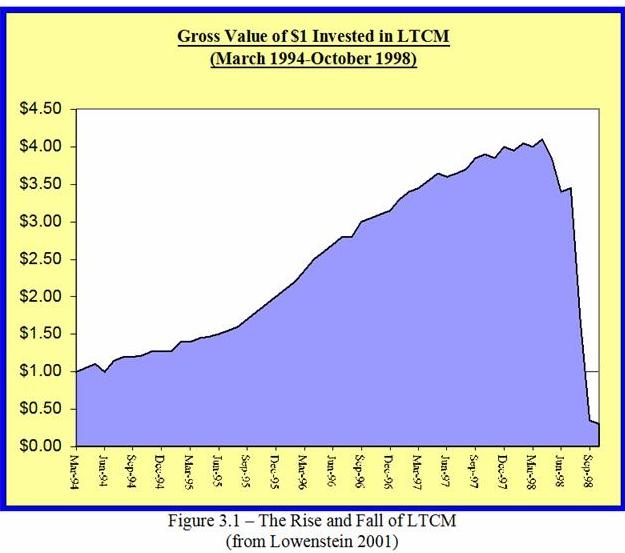

phi Mantra: LONG TERM CAPITAL MANAGEMENT (LTCM) : A debacle that every stock market analyst should understand

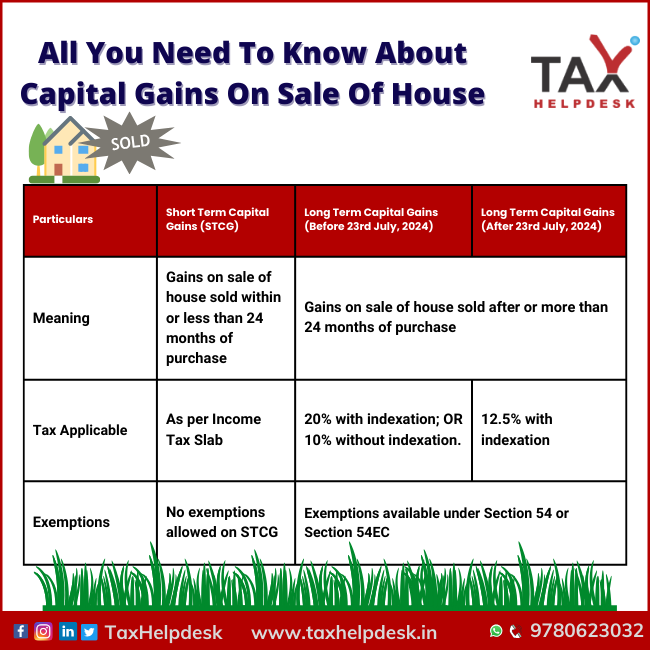

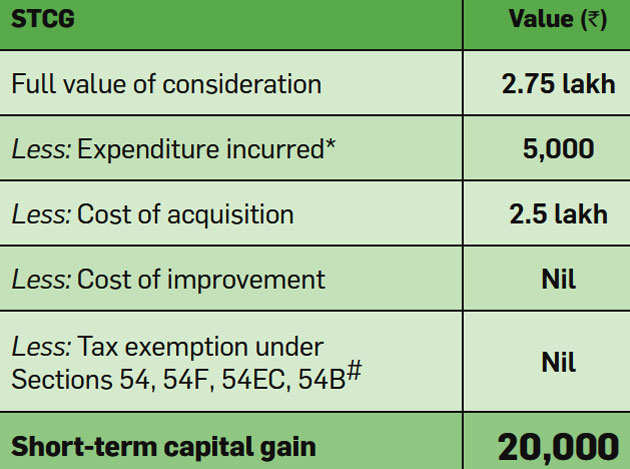

capital gain: How to calculate short-term and long-term capital gains and tax on these - The Economic Times

When Genius Failed: The Rise and Fall of Long-Term Capital Management: 9780375758256: Lowenstein, Roger: Books - Amazon.com

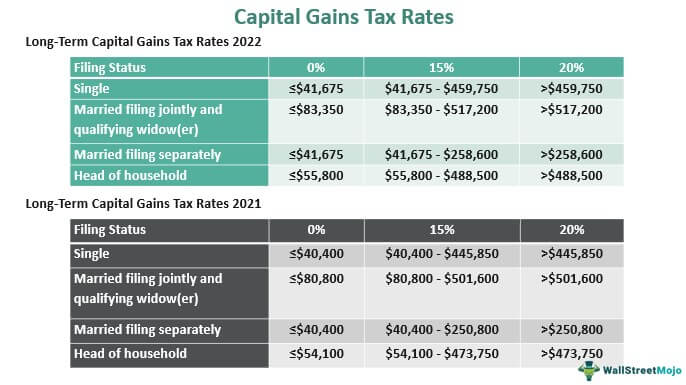

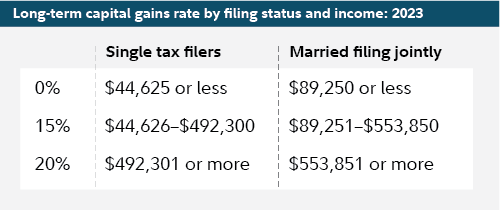

Capital Gains vs. Ordinary Income - The Differences + 3 Tax Planning Strategies - Kindness Financial Planning